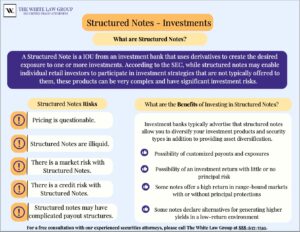

What are Structured Notes?

Structured notes are an IOU from an investment bank that uses derivatives to create the desired exposure to one or more investments. According to the SEC, while structured notes may enable individual retail investors to participate in investment strategies that are not typically offered to them, these products can be very complex and have significant investment risks.

A structured note combines two elements: A bond (that is supposed to protect your principal) typically makes up 80% of the investment, and the rest of your money is put into a derivative.

A derivative is a security that is dependent upon or derived from one or more underlying assets. For example, a structured note could derive its performance from the S&P 500 Price Index or the S&P TSX Global Gold Index or numerous others. It can also derive performance from a combination of indexes.

The investment bond element in structured notes can be designed to give a return that equals your initial investment, if you keep the product until maturity. The derivative element is designed to offer you the potential to achieve higher returns than a standard deposit.

Investment banks market a structured note for their ability to benefit from good stock market performance while simultaneously providing protection against bad market performance. The cost for this protection is covered by modifying the benefit. Unfortunately, the cost of the protection usually outweighs the benefit.

Stifel Nicolaus Multi-Million Dollar FINRA Claims involving Structured Notes Strategy

On August 16, 2023, Advisor Hub reported that customer complaints over a structured note strategy developed by a Stifel Nicolaus & Co. broker in Miami are piling up with another million-dollar claim.

According to the broker’s CRD, nine arbitrations have been filed including the most recent one on July 21, 2023. The total damages are reportedly at $24.5 million, with the individual disputes ranging from $500,000 to $5 million.

The complaints are reportedly against Stifel Nicolaus as a respondent, not the broker, and include claims of negligence, breach of fiduciary duty and unauthorized trading, according to the article. The notes were reportedly heavily weighted with a volatile biotech index or frequently traded to generate commissions, according to the article.

The broker allegedly overconcentrated the structured notes in stocks such as Dynatrace, Pinterest and Snapchat, or to potentially volatile indexes, including the SPDR S&P Biotech ETF (NYSE: XBI), according to Advisor Hub. When the stocks and biotech index took a dive in late 2021, the investors suffered significant losses, according to the article.

What are the Benefits of Investing in Structured Notes?

Investment banks typically advertise that structured notes allow you to diversify your investment products and security types in addition to providing asset diversification.

They also advertise that structured notes allow you to access asset classes that were previously only available to institutions or were hard for the average investor to access. (An asset class is a group of securities that exhibits similar characteristics, behaves similarly in the marketplace and is subject to the same laws and regulations.)

Structured Notes Benefits Touted by Investment banks:

-possibility of customized payouts and exposures

-possibility of an investment return with little or no principal risk

-some notes offer a high return in range-bound markets with or without principal protections

-some notes declare alternatives for generating higher yields in a low-return environment

Derivatives allow structured notes to align with any particular market or economic forecast. Additionally, the inherent leverage allows for returns being higher or lower than the underlying asset which it derives from.

According to Citibank, structured products can offer you the best of both worlds, combining growth potential, with the ability to protect your initial investment provided they are held till maturity and subject to credit risk of the issuer.

The Risks of Structured Notes

-Pricing is questionable. Structured notes rarely trade after being issued, so pricing is questionable. Prices are calculated by matrix which means the value is determined by the issuer.

According to PlanSponsor, the investor must take the time to understand how the notes are priced. The fees paid to the issuer and dealer on structured notes can be as little as 40 basis points or more than 100. The fees are difficult to isolate since they are hidden in the bid-ask spread.

At the same time, the average plan sponsor simply does not have the resources to reverse-engineer the more complex instruments to ascertain how they should be priced. The investor who does not call a number of dealers to price the same structure may never know if the pricing is fair.

-Structured Notes are illiquid. Structured notes cannot easily be sold or exchanged for cash without a substantial loss in value. If for some reason you need to exit early, your only option may be from the original issuer at whatever price they are willing to pay, if any. Structured Note terms are generally between 18 months and six years, and it is important that you can afford to tie up your money for that period, because your principal is only protected when Structured Notes are held for their full term.

-There is a market risk with Structured Notes. Some Structured Notes provide for the repayment of principal at maturity, which is often referred to as “principal protection.” This principal protection is subject to the credit risk of the issuing financial institution. Many structured notes do not offer this feature. For structured notes that do not offer principal protection, the performance of the linked asset or index may cause you to lose some, or all, of your principal, according to an investor alert issued by the SEC. Depending on the nature of the linked asset or index, the market risk of the structured note may include changes in equity or commodity prices, changes in interest rates or foreign exchange rates, or market volatility.

-There is a credit risk with Structured Notes. Since Structured Notes are an IOU from the issuer, you are left holding the bag if the investment bank forfeits the debt. The protection of principal is subject to the creditworthiness of the issuer. Structured Notes holders may lose up to 100% of their investment upon the bankruptcy of the issuer, even if the value of the reference asset is favorable. The creditworthiness of the issuer may change at any time during the term of the note. Not only are you taking a market risk, but also a credit risk.

– Structured notes may have complicated payoff structures. It can be difficult for you to accurately assess their value, risk and potential for growth through the term of the structured note. Determining the performance of each note can be complex and this calculation can vary significantly from note to note depending on the structure. Notes can be structured in a wide variety of ways. Payoff structures can be leveraged, inverse, or inverse-leveraged, which may result in larger returns or losses for you.

-Tax treatment can be tricky. You may wish to consult with a tax advisor before investing in Structured Notes. The tax treatment of structured notes is complicated and, in many cases, uncertain.

Questions to Ask Before Investing in Structured Notes

- What is the underlying asset or index that the note is linked to, and how does it perform?

- What is the maturity date of the note, and what happens if you need to sell it before maturity?

- What is the minimum investment required, and what are the associated fees and costs?

- What is the coupon rate or yield of the note, and how is it calculated?

- What is the credit rating of the issuer of the note, and how does this affect the risk of the investment?

- What is the likelihood of the note being called early, and how would this affect your investment returns?

- What are the potential tax implications of investing in structured notes?

- How does the payoff structure of the note work, and what are the potential risks and rewards?

- Are there any potential conflicts of interest between you and the issuer of the note?

- How does the performance of the note correlate with your overall investment strategy and risk tolerance?

Structured Notes in 2024

The White Law Group has been investigating brokerage firms who are improperly recommending Structured Notes to their clients, such as the following:

BNP Paribas 6Y U.S. Equity Autocallable Step-Up Note,

BofA Finance LLC 6Y U.S. Equity Contingent Coupon Callable Yield Note,

Citibank, NA 4Y S&P 500 Daily Risk Control 10% Index Market-Linked CD,

Citigroup Global Markets Holdings Inc. 3Y U.S. Equity Contingent Coupon Callable Yield Note,

Barclays Bank PLC 3Y U.S. Equity Contingent Coupon Memory Autocallable Yield Note,

Goldman Sachs Bank 6Y S&P 500 Index Market-Linked CD,

HSBC USA Inc. 3Y Nasdaq 100 Index Autocallable Accelerated Barrier Note,

Jefferies Group LLC 4Y S&P 500 Index Accelerated Barrier Note,

JP Morgan Chase Financial Company LLC 5Y International Equity Accelerated Barrier Note,

Morgan Stanley Finance LLC 5Y Euro Stoxx 50 Index ITM Digital Barrier Note,

National Bank of Canada 5Y U.S. Equity Contingent Coupon Autocallable Yield Note,

Royal Bank of Canada 5Y S&P 500 Index ATM Digital Fully Protected Note,

UBS AG 3Y U.S. Equity Contingent Coupon Callable Yield Note

FINRA Regulations

The Financial Industry Regulatory Authority (FINRA), the self-regulator that oversees brokers and brokerage firms, has established regulations that govern the sale of structured notes to investors. These regulations are designed to protect investors and ensure that they are provided with adequate information to make informed investment decisions.

FINRA Rule 2330 requires broker-dealers to make a reasonable effort to obtain information about the investor’s financial status, tax status, investment objectives, and other relevant information before recommending a structured note. This information is used to determine whether the investment is suitable for the investor.

FINRA Rule 2111 requires broker-dealers to have a reasonable basis for believing that a recommended transaction or investment strategy involving a structured note is suitable for the investor based on the information obtained through the reasonable diligence of the broker-dealer.

FINRA Rule 2210 requires that all communications related to the sale of structured notes be fair, balanced, and not misleading. Communications must also provide a sound basis for evaluating the facts regarding the investment and disclose any material risks associated with the investment.

FINRA also requires broker-dealers to disclose the fees and charges associated with the purchase of a structured note, including any commissions, markups, or markdowns. In addition, FINRA requires that broker-dealers provide investors with a prospectus that contains detailed information about the structured note, including its terms, risks, and fees.

FINRA and SEC Sanctions involving Structured Notes

There have been cases where broker-dealers have been disciplined by FINRA for the sale of structured notes. FINRA has taken disciplinary action against broker-dealers for a variety of reasons, including failing to disclose the risks associated with structured notes, making unsuitable recommendations to clients, and failing to supervise the sale of structured notes.

The SEC initiated a cease and desist order on July 30, 2021 and fined Herbert J Sims & Co., a registered broker-dealer based in Fairfield, CT, $250,000 for allegedly making unsuitable recommendations of certain highly-complex and high-risk variable interest rate structured products.

From January 2015 through April 2018 thirteen registered representatives from Herbert J Sims’ Boca Raton, Florida branch office purportedly recommended variable interest rate structured products to forty-five customers for whom such investments were reportedly unsuitable considering their financial situations and needs.

In September 2019, FINRA censured and fined Newbridge Securities for allegedly failing to establish and maintain a supervisory system, and procedures concerning the sale of complex securities such as structured notes and leveraged, inverse and inverse-leveraged exchange-traded funds that were reasonably designed to achieve compliance with FINRA’s suitability rule.

One notable case involved UBS Financial Services, which was fined $15 million by FINRA in 2011 for allegedly making unsuitable recommendations of Lehman Brothers structured notes to some of its clients. The notes, which were linked to the performance of Lehman Brothers, lost value significantly when the firm declared bankruptcy in 2008. UBS was also required to pay restitution to certain customers who had sustained losses as a result of the unsuitable recommendations.

Another case involved Wells Fargo Advisors, which was fined $3.25 million by FINRA for allegedly making unsuitable recommendations of certain structured products to clients. FINRA found that Wells Fargo failed to properly train its representatives on the risks associated with these products and that some representatives made unsuitable recommendations to clients.

These cases highlight the importance of broker-dealers complying with FINRA’s regulations when selling structured notes, and the potential consequences of failing to do so. Investors should also be aware of the risks associated with structured notes and carefully evaluate the investment before making a decision.

Brokers Duty of Due Diligence

Brokers often pitch structured products as providing “downside protection” against losses to a related index while allowing modest upside gain potential. However, investors in structured notes are finding out that the protection offered is limited and insufficient to ward off enormous losses.

Brokerage firms are required to perform adequate due diligence on any product they recommend. They must ensure that all recommendations are suitable for their client in light of the client’s age, investment experience, net worth, income, and investment objectives.

If a brokerage firm fails to perform adequate due diligence or makes an unsuitable investment recommendation, the firm can be held responsible in a FINRA Arbitration claim.

Free Consultation with a Securities Attorney

If you suffered losses investing in structured notes with your financial advisor and would like to discuss your litigation options, please call The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions attempt to recover their investment losses. With offices in Seattle, Washington and Chicago, Illinois, the firm reviews securities fraud cases throughout the country.

For more information on the firm and its representation of investors in FINRA arbitration claims, visit https://whitesecuritieslaw.com.

Tags: Barclays Accelerated Return Notes losses, Barclays Bank PLC Trigger Phoenix Autocallable Optimization losses, BofA paribas, Chicago securities attorney, Chicago securities lawyer, Credit Suisse Market Linked Notes lawsuit, HSBC USA notes, JPMorgan chase financial barrier note, Morgan Stanley callable note, RBC structured notes, securities fraud attorney, structured note class action, Structured note investigation, structured notes investigation, structured notes investment losses, structured notes lawsuit, UBS structured notes lawsuit, What is a structured note? Last modified: March 6, 2024