Mackenzie extends offer to purchase New York City REIT Class B shares for $6.50 per share.

The White Law Group continues to investigate potential claims involving New York City REIT and the liability that brokerage firms may have for improperly recommending high-risk non-traded REITs to investors.

According to a letter to investors on December 28, Mackenzie Realty Capital LP, has extended an unsolicited tender offer to purchase shares of New York City REIT Class B shares for $6.50 per share. The original offering price of the REIT was $25.00 per share.

Mackenzie is apparently offering to purchase the shares that were not tradeable when the REIT began trading on the New York Stock exchange. Before listing 25% of its shares for trading, New York City REIT implemented a 2.43 -1 reverse stock split and distributed 3 shares of Class B common stock for each post-split Class A share.

Class B Shares are not tradeable until they are converted into Class A Shares.

Conversion of the Class B Shares was to occur at three equal intervals on December 16, 2020, April 15, 2021 and August 13, 2021, notes Mackenzie. While the first 1/3rd should have converted, Mackenzie is offering to buy the remaining 2/3rds, according to the letter.

Since listing, the Class A Shares have traded well under the REIT’s most recent estimated NAV, which was $49.23 per Share as of June 30. Class A Shares have had closing prices ranging from $9.12 to $17.60 per share since their August 18th listing date.

Further, the Share Redemption Program (SRP) was terminated.

Recovery of Investment Losses

Non-traded REITS are considerably more complex than traditional investments and usually involve a high degree of risk. Unfortunately many investors were unaware of the risks and liquidity problems associated with non-traded REITs, when they were sold the investments. They also may come with high fees and commissions.

Broker dealers are required to perform adequate due diligence on any investment they recommend and to ensure that all recommendations are suitable for the investor. Recommendations should be in line with the investor’s age, risk tolerance, net worth, and investment experience.

If a broker dealer fails to adequately disclose risks or make unsuitable investment recommendations, it can be held liable for investment losses.

If you are concerned about your investment in New York City REIT, the securities attorneys at The White Law Group may be able to help you. Please call The White Law Group at 1-888-637-5510 for a free consultation with an experienced securities attorney.

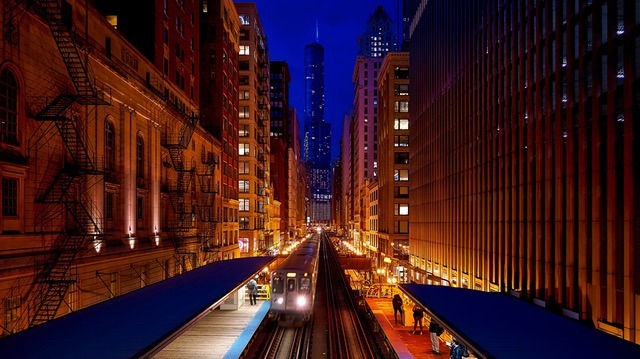

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois.

For more information on The White Law Group and its representation of investors, please visit our website at www.whitesecuritieslaw.com

Tags: New York City REIT complaints, New York City REIT investigation, New York City REIT lawsuit, New York City REIT losses, New York City REIT recovery options, New York City REIT secondary sales, New York City REIT SRP, New York City REIT tender offer, New York City REIT class action lawsuit, New York City REIT NAV, New York City REIT Shareholders Last modified: February 12, 2021